E. The transfer of a debt collection file

1. How and when exactly should you submit a collection?

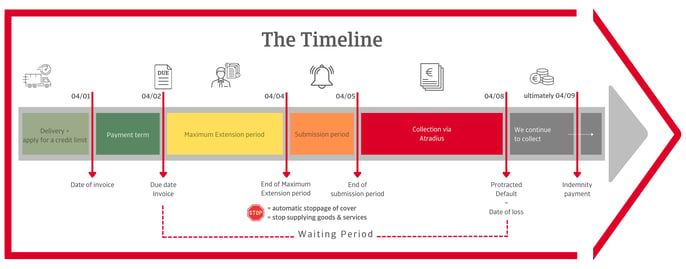

After the overdue period has expired, you still have 30 days to submit the entire claim to us for collection. This concerns all past due and non-due invoices. If several invoices have not been paid, the due date of the oldest outstanding invoice applies, subject to a few exceptions. The filing date is therefore calculated from that due date for almost every policy.

De tijdlijn

factuur

achterstalligheidstermijn

= leveringsstop

indieningstermijn

insolventie

=

schadedatum

Opgepast: Wanneer u in uw polis met een 'afwijkende achterstalligheidstermijn' werkt, dan kan u deze kalenderfunctie niet gebruiken. Gelieve contact op te nemen met het Customer Service Centre.

|

NEW The interactive timeline NEW Using this interactive timeline, you can enter your invoice date and due date and click on your maximum extension period, then the interactive timeline will tell you the exact dates for ultimate claim submission, the date of loss and the ultimate date by which we will pay out your indemnity. Click on the timeline above to make it interactive |

Click here for a print version of the timeline

Good debt collection starts with prompt intervention. So don't hesitate to transfer a file earlier if you notice that your own reminders are not yielding results. So don't necessarily wait for the end of the deadline.

Is it about established insolvency (bankruptcy, WCO, etc.)? Do not hesitate and immediately transfer the complete file to Atradius. Insurer's liability will then be paid within 30 days. For your information: Atradius regards the 'Wet op de Continuïteit van Ondernemingen' (Belgian legislation) or the 'Redressement Judiciaire' (French legislation) as established insolvency. Otherwise, in the case of so-called protracted default, you have to take all protective measures. In other words, take all possible measures to get your invoices paid.

All files are submitted to our collection department via Atrium. This way, we immediately have all the necessary information and documents for a quick and correct start of the procedure.

If you want to transfer a file to us in protective custody, always contact our Customer Service Centre.

2. Management of a non-covered file

You can also transfer files not covered by the policy for collection, with the exception of:

- claims falling under the intervention threshold;

- claims in which a judgement has been obtained;

- queried invoices, where a technically founded dispute has been raised by the debtor and which cannot be handled by our debt collection department. If you want to safeguard your right to compensation for this type of case, you can:

- Simply continue to deliver to this debtor if the 'Disputed claims' module is in your policy and its amount is not exceeded. The condition is that the debtor pays all other claims properly.

- Contact the Customer Service Centre for advice.

- Submit via Atrium stating that it is a disputed claim.

You will find the rate for collecting such an unsecured claim in your Collections contract. These collection costs are therefore for your own account.

Do you have any questions? Feel free to ask them to your contact person at the Customer Service Centre. In consultation with Atradius Collections we will examine with you the options for managing your unsecured claims.